- Newest

- Most viewed

Interested in a Link Placement?

Calorie Restriction for Weight Loss: Science, Strategies & Tips

Learn how calorie restriction supports weight loss, how much to cut, and tips for doing it safely without slowing your metabolism.

Work Wellness | May 8, 2025 427 views

Brainway App Review: Can It Really Help With Procrastination?

Productivity | May 5, 2025 896 views

Autonomous Mother’s Day Sale 2025 – Terms & Conditions

Latest Updates | May 4, 2025 971 views

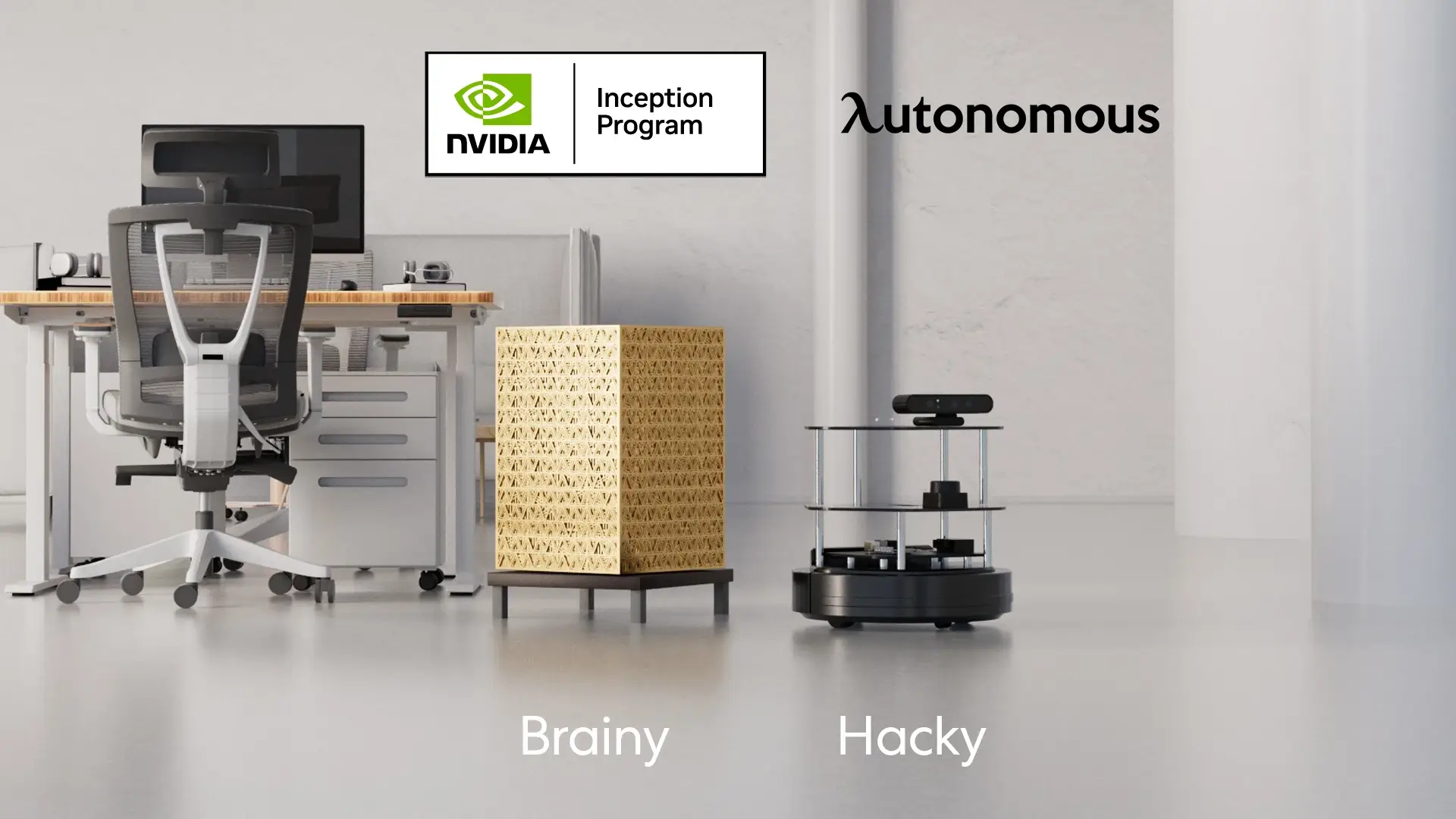

Autonomous Joins NVIDIA Inception Program

Latest Updates | Apr 28, 2025 501 views

Liven App Review: A Mental Wellness Tool for Productivity and Focus

Work Wellness | Apr 28, 2025 851 views

Stool vs. Chair: Which is Better for Your Comfort?

Smart Products | Apr 24, 2025 861 views

Understanding Standing Desk Prices: What to Expect at Every Budget

Smart Products | Apr 22, 2025 498 views

The 5 Best Office Chairs for Bedroom Setups in 2025

Smart Products | Apr 21, 2025 1,264 views

Best Office Chairs for Managers That Lead in Comfort and Support

Smart Products | Apr 18, 2025 1,357 views

Top 5 Adjustable Metal Standing Desks Worth Buying

Smart Products | Apr 17, 2025 960 views

Best Office Chairs for Carpeted Floors: Comfort, Durability, and Style

Smart Products | Apr 16, 2025 1,325 views

10x10 Office Shed for Remote Workers: A Productive, Distraction-Free Space

Workplace Inspiration | Apr 15, 2025 1,049 views

.svg)