All About Home Office Tax Deduction 2024 to Know

Table of Contents

If you're among the growing number of individuals working from home, the prospect of unlocking the home office tax deduction for 2024 could significantly impact your financial landscape. This tax break offers the opportunity to deduct certain expenses related to your home office setup, providing a potential boon to your bottom line. However, understanding the nuances of eligibility, calculation methods, and potential pitfalls is crucial for navigating the complex terrain of the home office tax deduction. Let's delve into the key points that will empower you to make the most of this deduction and full guide to how to use home office tax deduction.

About Home Office Tax Deduction

1. Employee Status Matters

Unfortunately, if you are a regular employee who works from home, you are not eligible to claim the home office deduction on your federal income tax return. This is an important fact to keep in mind. Between the years 2018 and 2025, this deduction will be temporarily off limits for employees.

2. Self-Employed, Independent Contractor, or Gig Worker? You May Qualify

For those in the realm of self-employment, independent contracting, or gig work, there's a potential silver lining. You may be able to claim the home office deduction on Schedule C (Form 1040) if you meet specific home office tax deduction requirements. This involves using part of your home exclusively and regularly as your principal place of business or as a space to meet with clients, customers, or patients.

3. Choose Your Method Wisely: Simplified vs. Regular

When it comes to calculating your home office deduction, you have two paths: the simplified method or the regular method. The simplified method allows a straightforward deduction of $5 per square foot of your home office layout, up to a maximum of 300 square feet and $1,500. On the other hand, the regular method requires a more detailed approach, involving determining the percentage of your home used for business and applying it to actual expenses like mortgage interest, rent, insurance, utilities, repairs, and depreciation.

4. Records Are Your Allies

Regardless of the method you choose, meticulous record-keeping is a must. If you opt for the regular method, you'll need to keep records and receipts of your home office expenses, reporting them on Form 8829 (Business Use of Your Home) and attaching them to your Schedule C. Even if you use the simplified method, maintaining records of the square footage of your home office is essential.

5. Beware of Pitfalls

The watchful eye of the IRS accompanies the allure of the home office deduction. Exercise caution to avoid common mistakes, such as claiming personal expenses as business expenses, using your modern home office for non-business purposes, or attempting to deduct more than your income allows.

Navigating the complexities of the home office tax deduction requires a strategic approach, attention to detail, and a clear understanding of your specific circumstances. By aligning with the guidelines outlined above, you'll be better equipped to harness the full potential of the home office tax deduction for 2024. Remember, knowledge is your greatest asset in this financial landscape, so arm yourself accordingly and embark on the journey to unlock your tax-saving opportunities.

Save Money With Autonomous Bulk Order Program

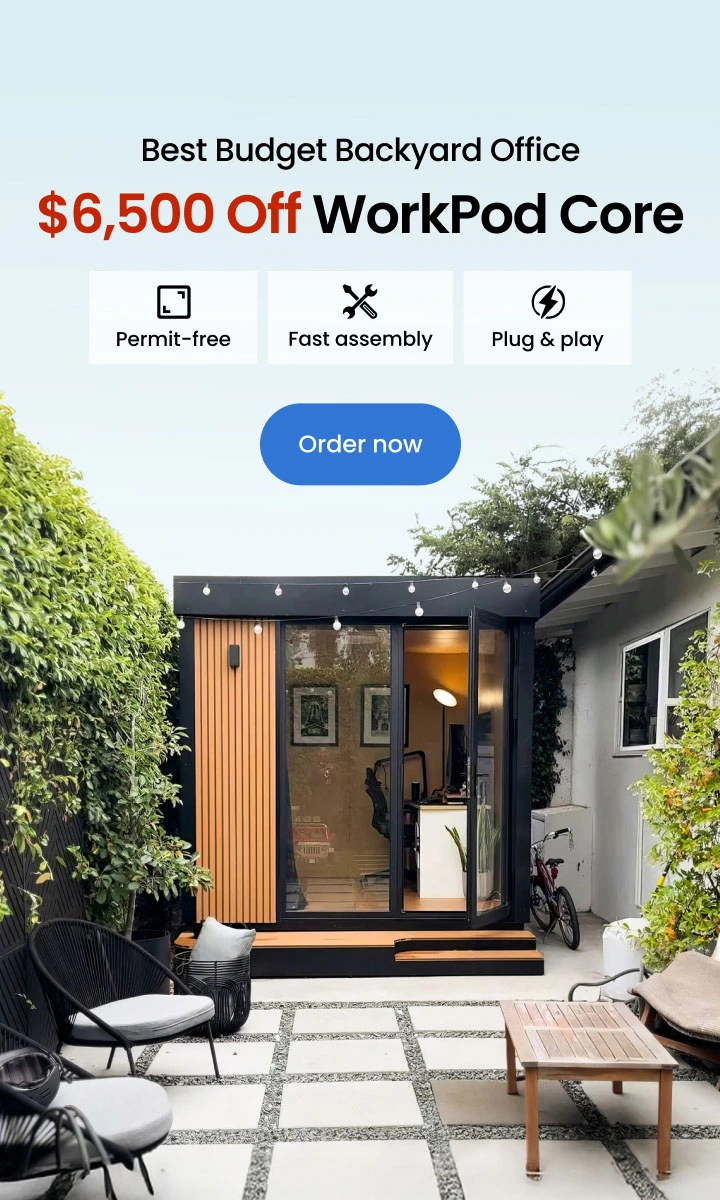

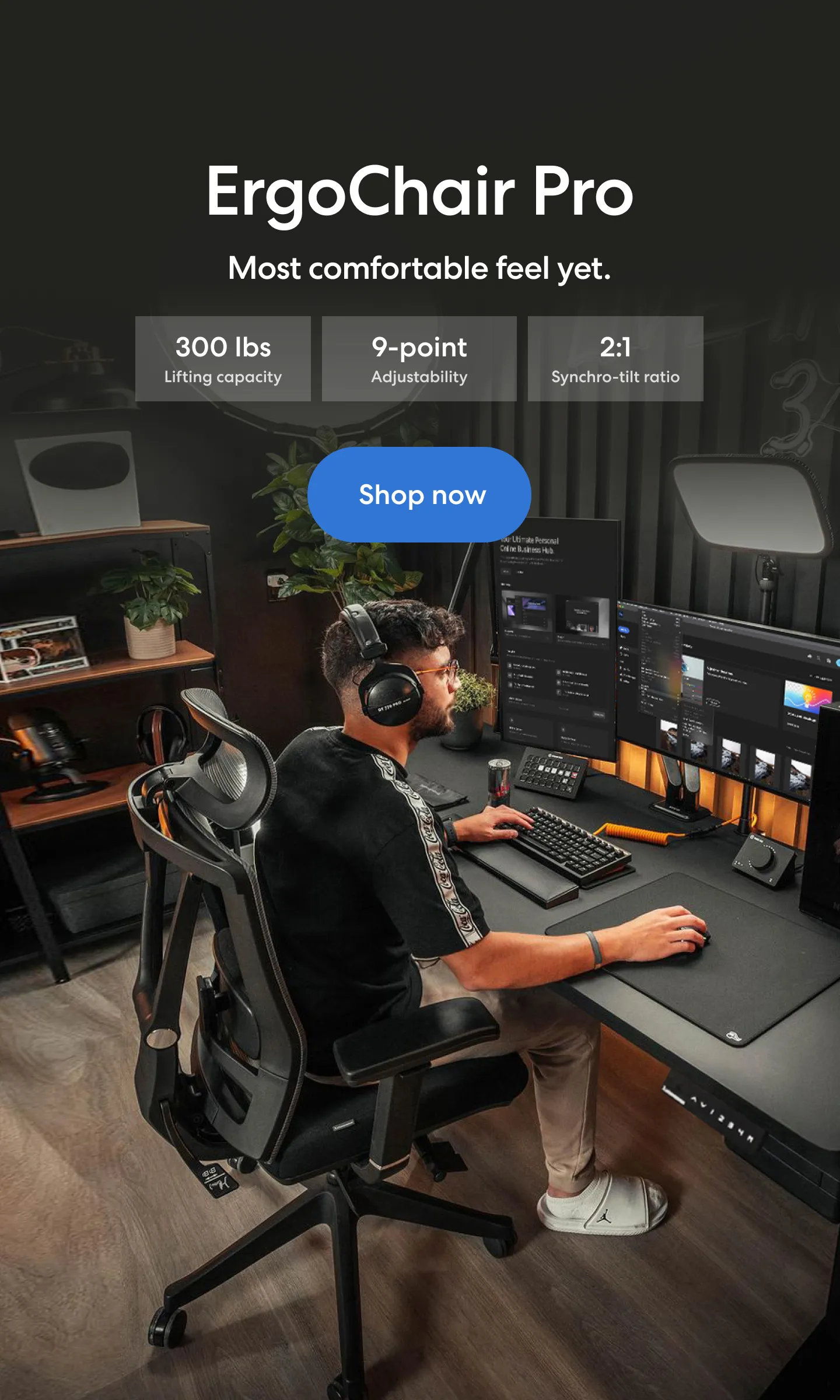

There is another way to save money for your workspace with Autonomous, where maximum efficiency meets unparalleled comfort. Discover exclusive bulk pricing options for a variety of products, including sought-after double desk home office setups, premium wholesale office furniture, and essential office equipment.

Autonomous offers a range of meticulously crafted ergonomic designs to enhance any work environment. From dynamic desks to ergonomic chairs of all kinds, they have a solution tailored to their unique needs.

For those seeking to transform their workspace with ergonomic excellence, visit the Autonomous Bulk Order Program. It's an opportunity to seize the best savings and elevate their workspace to new heights!

FAQs

1. What expenses qualify for the home office tax deduction?

Eligible expenses include a range of items such as furniture, equipment, utilities, and even a portion of homeowner expenses like mortgage interest and property taxes.

2. Can a remote employee claim the home office tax deduction?

How about a home office tax deduction for remote employee? Actually, remote employees can qualify for the home office tax deduction if they meet specific requirements, such as using a dedicated space exclusively for work.

3. How does the simplified method differ from the regular method?

The simplified method offers a straightforward $5 per square foot deduction, while the regular method involves calculating the percentage of your home used for business and applying it to actual expenses.

4. Is there a limit to the size of the home office that can be deducted?

Yes, under the simplified method, the deduction is capped at 300 square feet, amounting to a maximum deduction of $1,500.

5. What records should be kept for the home office tax deduction?

Keeping meticulous records and receipts of all expenses incurred by the home office is an essential component of the regular method. Keeping accurate records of the square footage of your home office is essential, even if you take the simplified approach.

6. Can I claim both furniture and equipment expenses under the home office tax deduction?

Yes, both furniture (such as desks and chairs) and equipment (like computers and printers) used exclusively for your home office can be claimed as eligible expenses under the home office tax deduction. Keeping detailed records of these purchases is crucial for maximizing your potential deduction.

Conclusion

Understanding the nuances of the home office tax deduction is key to unlocking substantial savings. From qualifying expenses to choosing the right deduction method, remote employees and self-employed individuals can leverage this opportunity to optimize their tax returns. By incorporating ergonomic solutions like double desk home office setups and wholesale office furniture from Autonomous, individuals not only enhance their workspace but also contribute to their deductible expenses. Remember, knowledge is the cornerstone of financial empowerment, and with these insights, you're well-equipped to conquer the complexities of the home office tax deduction in 2024. Explore more about home office expenses tax deduction and make the most of this valuable opportunity for savings!

Spread the word

.svg)

.webp)

.webp)