.webp)

Dub App Review: Is This Trading Platform Worth It?

Table of Contents

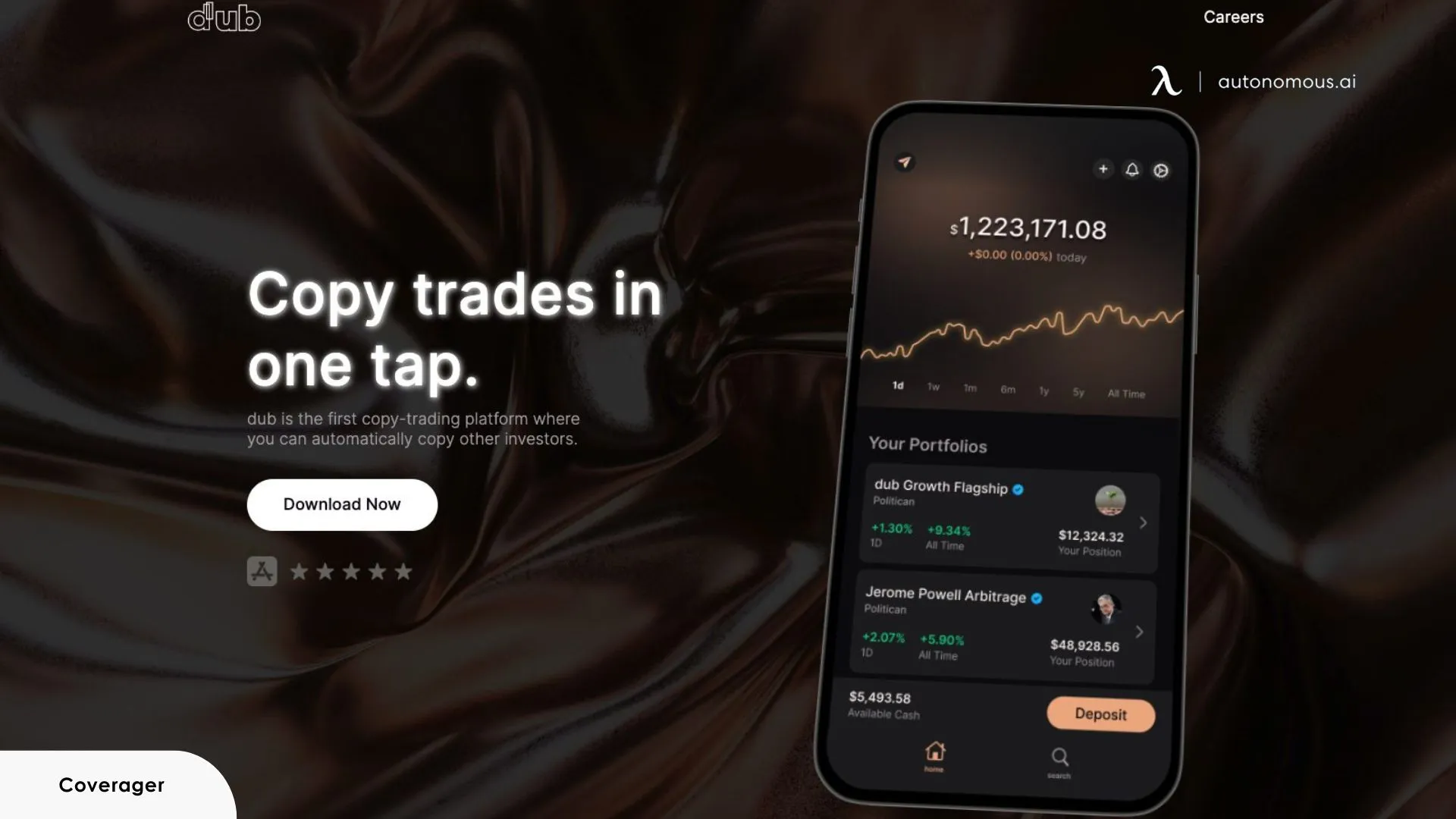

Copy trading used to sound like something reserved for pros and hedge fund insiders. But then I came across Dub—an app that pitches itself as “Instagram for investing”. Intrigued by the concept and driven by curiosity (plus the promise of only needing $100 to start), I gave it a shot.

In this Dub app review, I’ll walk you through what the platform actually does, what it gets right, and where it still has some work to do, based on my time using it and real feedback from other users. I’ll also dive into some Dub trading app review complaints to make sure it’s objective and realistic.

What Is Dub App?

At its core, Dub is a social investing app where you can either:

- Copy other investors’ portfolios, including hedge fund managers, influencers on X (formerly Twitter), and skilled everyday traders

- Create your own portfolio that others can copy, essentially becoming the influencer

The idea is simple: follow and copy the portfolios of experienced investors or create your own portfolio for others to copy. It’s like following your favorite creators on Instagram, but instead of liking their photos, you’re investing in their stock picks.

Here’s how it works: Instead of picking individual stocks, you copy an entire portfolio (like an ETF). Dub automatically mirrors the trades in your account, so when a trader buys Apple, you buy Apple. When they sell Tesla, you sell Tesla—automatically and in real-time. The best part? You can do all this with as little as $100.

A Step-by-Step Guide To Using The Dub App

Here’s how you can use the Dub investing app to get started:

1. Sign Up And Set Up Your Account

When you first download the Dub investing app, you’ll be asked to create an account using basic details such as your name, phone number, and email address. You'll also need to add payment information to get started, but don’t worry—there's a free 7-day Premium trial to try out the features before committing.

2. Deposit Funds Into Your Account

Once you’ve created your account, the next step is to deposit funds into your Dub trading app account. The minimum deposit to start using the app is $100, which is ideal for beginners looking to try out copy trading without committing too much capital upfront. You can use your credit card or another payment method to fund your account.

3. Browse And Select Portfolios To Copy

Now, the fun part begins: browsing portfolios. The Dub trading app allows you to follow a variety of portfolios created by professional investors, hedge fund managers, and social media influencers in the finance section from X (formerly Twitter) or other financial platforms. You can search for portfolios by category, including:

- Popular traders: Those who have a solid track record

- Hedge funds: Public filings such as 13F reports

- Users like you: Regular people sharing their portfolios for others to copy

Each portfolio will show you its real-time performance, including gains and losses.

My Tip: Look for portfolios with a consistent history of performance and consider diversifying your portfolio by copying multiple strategies.

4. Copy A Portfolio

When you find a portfolio you like, you can copy it with as little as $100. Dub will automatically divide your investment among the stocks in the portfolio based on their percentage weight. If a trader buys Apple, you’ll buy Apple. If they sell Tesla, you’ll sell Tesla—automatically and in real-time (though there can be slight delays).

My Tip: Always double-check the portfolio’s performance history before copying, and remember, past performance is not always indicative of future results.

5. Monitor And Adjust Your Portfolio

Once you've copied a portfolio, Dub will automatically mirror all trades made by the original portfolio. However, you may not want to just sit back and forget about it. You should regularly check on your investments, especially if you're using Dub for longer-term growth.

My Tip: Make sure to monitor the performance and see how each stock in the portfolio is doing. This way, you can gauge whether the portfolio is still a good fit for your investment goals.

If you’re looking to become more tech-savvy, especially when it comes to managing your trading setup, our guide on how to become computer-savvy can provide valuable tips to streamline your trading processes.

6. Create Your Portfolio (If You’re Ready)

If you feel confident in your investment skills, you can also create your own portfolio and share it with others. This feature allows you to choose which stocks you want to include and set the percentage for each one.

My Tip: Be transparent and consider building a diverse portfolio to attract more followers. Track your performance and make adjustments as needed. If your portfolio does well, others will likely follow it!

If you're someone who stays updated with business tech trends and wants to know how emerging technologies can improve your investing game, check out our article on business tech trends and learn what’s coming next in the world of finance and investment.

7. Upgrade To Premium For More Features

For full access to Dub’s features—like copying unlimited portfolios and creating your own—you’ll need Dub Premium. There’s a 7-day free trial to test out Premium, and after that, you can choose either a monthly or annual subscription.

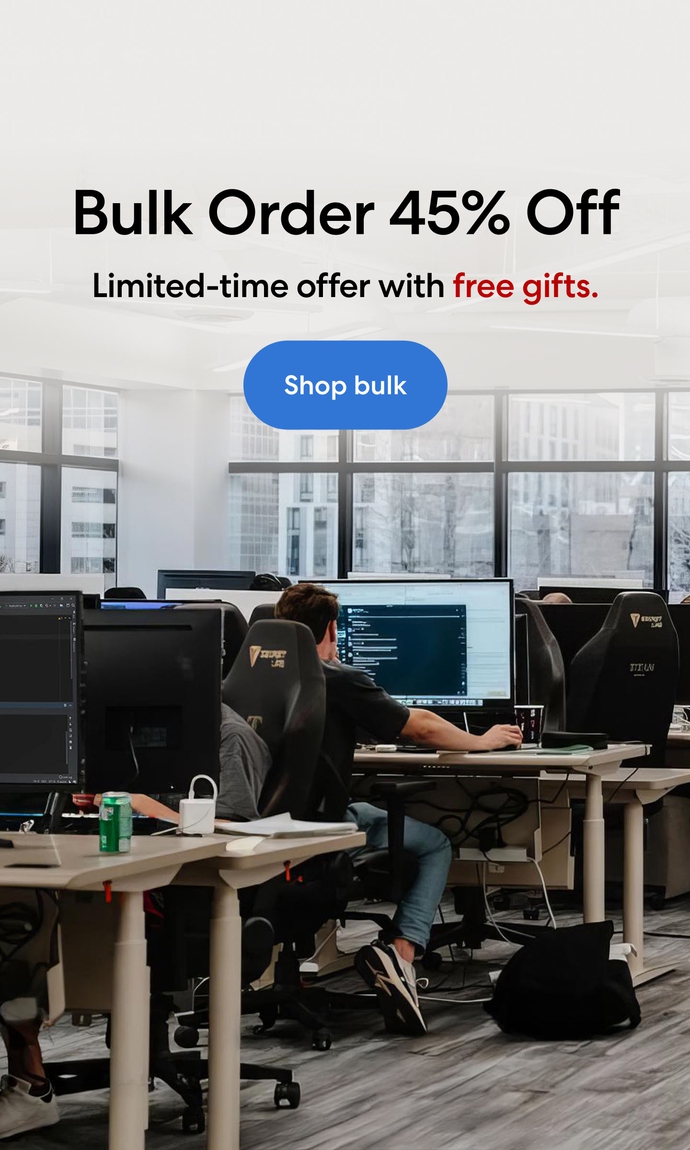

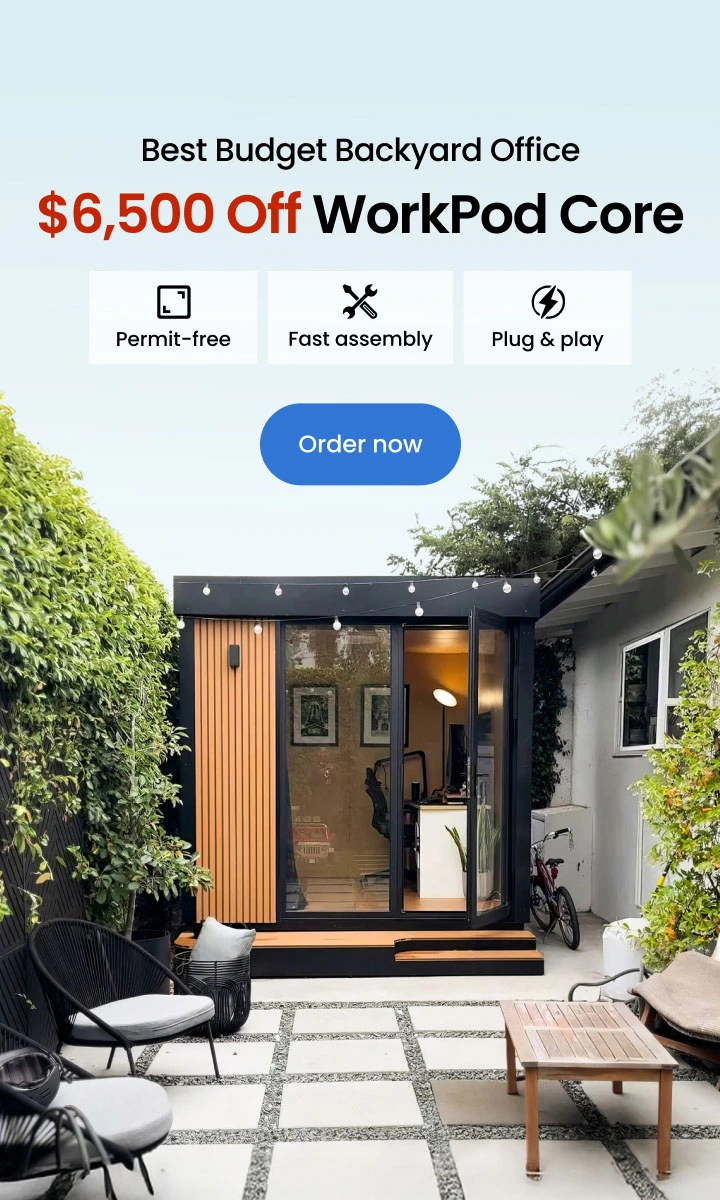

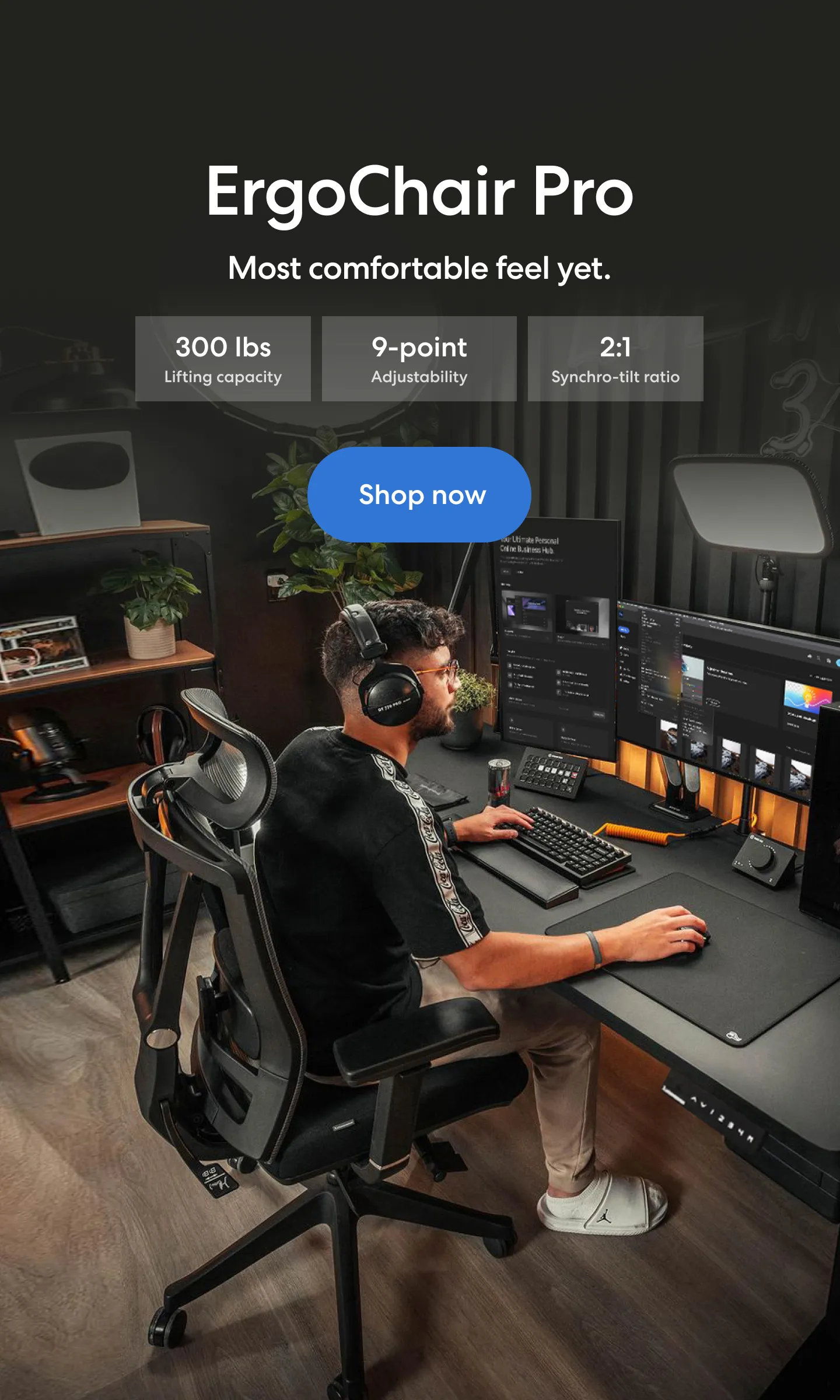

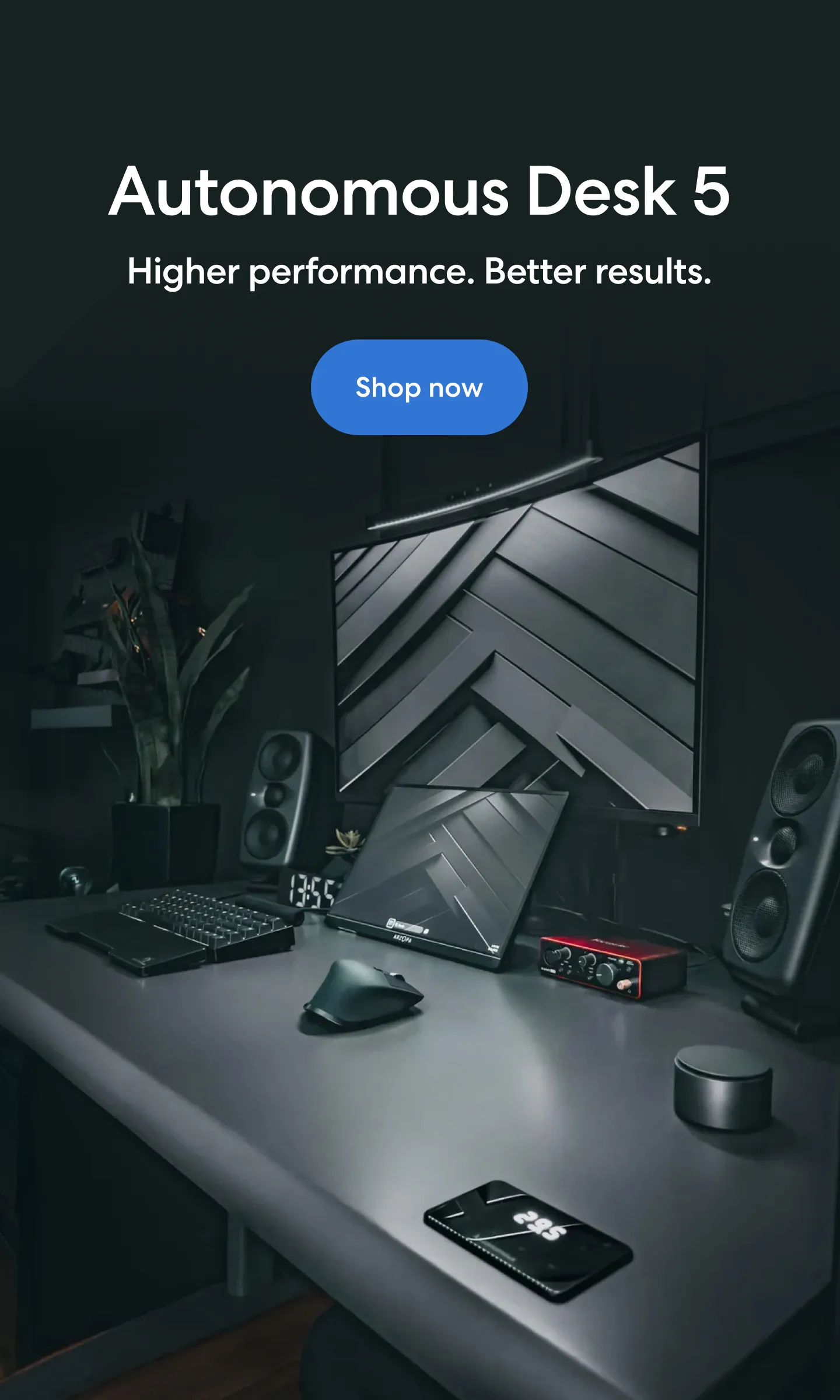

If you're interested in creating the ideal space for your investment activities, take a look at our guide on building the perfect trading desk setup to enhance your productivity and focus.

However, you’re into advanced trading setups that can improve your performance, and want to upgrade your setup to a new level. A 4-monitor setup for trading could help increase your screen real estate for watching multiple portfolios and monitoring market movements.

For those who need even more screens, we have guidelines and unique inspirations on setting up a 6-monitor trading setup and even an 8-monitor trading setup for serious day traders.

What I Liked About Dub

After using Dub for a few weeks, I can say the app gets a lot of things right, especially for those who are new to investing or simply want a less hands-on approach. But it’s not just my experience that says so—many reviews echo the same positive points.

1. Intuitive Interface And Easy Onboarding

From the start, Dub is easy to navigate. The sign-up process was straightforward: create an account, deposit funds, and you're ready to copy a portfolio in minutes. It reminded me of how simple it is to follow a playlist on Spotify, but instead of music, you’re investing in someone’s curated set of stocks.

Many users agree with this experience:

“Love using Dub. I think it’s fairly intuitive.”

— A Dub trading app review from App Store Reviews

Even those who aren’t well-versed in investing found the layout clear and accessible. I personally appreciated the minimal setup required to get going—no paperwork, no calls with advisors, no steep learning curve. For people who want to just dip their toes in the market, this is a big win.

2. A Social Investing Experience That Feels Engaging

Dub’s real differentiator is its social layer. You can browse through a variety of portfolios—some built by finance influencers from X (formerly Twitter), others by regular users modeling 13F filings from hedge funds. What’s more, you can see performance charts, gain/loss stats, and copy the portfolio in one tap.

“It’s been great to follow other portfolios with. The ability to just copy a portfolio and ride the highs or lows makes this app one of a kind.”

— A Dub app review from App Store Reviews

The sense of community and competition is real, too. This investing app encourages users to build their own portfolios and let others follow them, with real-time stats showing who’s doing well. It’s a great way to get inspired—or test your own skills.

3. Fractional Investing Makes It Affordable

I was genuinely surprised that $100 is all you need to start investing in entire portfolios. Thanks to fractional investing, you don’t need to buy whole shares of Amazon or Tesla—you just buy into the portfolio at whatever amount you’re comfortable with.

That low entry point removes a huge barrier, especially for younger investors or anyone just trying out copy trading for the first time.

4. Responsive Support That Listens

Dub seems to genuinely care about its user base. I didn’t need help during my trial, but quite a few users noted that the customer support team is fast, friendly, and open to feedback, which is promising for an app that’s still growing.

“I think this app has a great support team, and I hope this app goes far in the future by listening to the comments from its users.”

— A Dub trading app review from App Store Reviews

All in all, Dub delivers on ease, accessibility, and a modern investing experience that feels built for today’s users, not just Wall Street pros.

What Dub Still Needs To Improve

That said, Dub isn’t perfect, and for all its innovation, there are still some important areas that need work. These issues were noticeable in my own experience and are backed up by repeated dub app review complaints from different users.

Here is the realistic perspective of the Dub trading app reviews:

1. Trade Execution Isn’t Always Real-Time

One of the app’s promises is that when you copy a portfolio, your trades happen at the same time and price as the original investor. But in reality, I noticed some delay. Even a short lag can make a difference, especially during volatile market conditions where prices can swing fast.

“It doesn’t trade as quickly as the supposed mirrored portfolios, so you take swing losses.”

— A Dub trading app review from App Store Reviews

So while Dub aims to mirror trades in real time, the execution isn’t always that precise, which could cost you if timing is critical.

2. Portfolio Transparency Needs Work

Once you’ve copied a portfolio, it’s surprisingly difficult to get a clear picture of how each individual stock is performing. You can see your total investment and general gain/loss, but you don’t get a full breakdown—like which stocks are up, which are down, and how many shares you own

“It isn’t easy to view your live portfolio… I’d like to see which stocks in the portfolio I am copying are doing the best vs the worst.”

— A Dub investing app review from App Store Reviews

Worse yet, when I bought more shares from a portfolio, the update didn’t reflect in my app right away, even though the order was filled. That makes it hard to track performance or troubleshoot if something feels off.

For a platform that prides itself on simplicity, it ends up making basic portfolio tracking harder than it needs to be.

3. Hidden Fees That Sneak Up On You

Dub’s front-end experience is polished, but the back-end costs aren’t always transparent. While using the app feels free (or cheap with Premium), users are still paying brokerage trade fees in the background. These aren’t always obvious until they start eating into your gains, especially if you’re investing less than a few thousand dollars.

“Tons of hidden trade fees will kill most of your gains if you are investing less than $10k.”

— A Dub stock app review from App Store reviews

For me, the fees weren’t outrageous, but I did notice they added up faster than I expected. If you’re trading frequently or copying active portfolios, this could impact your long-term returns more than you think.

4. Lack Of Risk Guidance And Educational Tools

While Dub makes investing easier, it doesn’t do much to educate users about risk or help them assess which portfolios are safe, speculative, or somewhere in between. That’s a problem, especially for new investors who might think copying a high-performer guarantees similar results.

“Dub doesn’t seem to offer sufficient tools or insights to help users make informed decisions…”

— A Dub investing app review from Apple Store Reviews

In my experience, it’s easy to get lured by flashy returns without context. I would’ve loved to see a risk rating system, deeper analytics, or even basic strategy breakdowns explaining a portfolio’s logic.

5. Focus On Flashy Features Over Core Functionality

A few users—and I agree—feel like the dev team is sometimes more focused on small design touches or social gimmicks than on fixing critical bugs or data display issues.

“The development team is more focused on little fancy features than the fundamental functionality of the app.”

— A Dub stock app review from Apple Store Reviews

For example, the algorithm calculating total gains/losses can feel unreliable at times, and there’s no simple way to understand your net performance across different copied portfolios. These are the basics—and they need attention.

6. Privacy Concerns During Sign-Up

A consistent complaint from users on CH Play (Google Play) is about the sign-up process, which asks for your name and phone number upfront—then takes you directly to the payment info screen. This sudden jump raises red flags for many users who are still trying to understand what the app even offers.

“I, and I’m sure many others, don’t feel comfortable signing up for a free trial without seeing more of the platform.”

— A Dub investing app review from CH Play Reviews

Some users feared their personal data might be sold, even though the Dub team has publicly stated they’re not a scam and do not sell data. Regardless, the process feels pushy and unclear, especially for first-time users. In today’s digital world, transparency around data privacy is non-negotiable, and Dub still has room to improve here.

So, Should You Use Dub?

Here’s the deal: Dub is a great starting point for new investors who want a simpler, more social way to engage with the stock market. The concept is solid, the UI is beginner-friendly, and copying portfolios really does save time.

But if you’re looking for precise performance tracking, fast execution, and full fee transparency, Dub might not be there yet. It’s more of a learning tool than a professional-grade platform.

If you’re curious, I’d still recommend trying the free Premium trial—but go in knowing that results aren’t guaranteed, and you’ll need to manage expectations.

FAQs

1. How much does the Dub app cost?

Dub is free to explore. If you want to actively copy or create multiple portfolios, you’ll need Dub Premium—available through a monthly or annual subscription. The first 7 days are free, so you can test it out before committing. Just keep in mind that brokerage fees still apply behind the scenes. After that, you can choose between two subscription plans: $9.99/ month or $89.99/ year (saving 25% with annual billing).

2. How does the Dub app work?

You browse portfolios built by other users or professionals, pick one that fits your goals, and invest however much you want (minimum $100). Dub then mirrors their trades in your account. If they buy Apple or sell Tesla, you do too—automatically, and proportionally to your investment.

3. Is it safe in copy trading?

Technically, yes—it’s secure in terms of account safety and trade execution. But copy trading carries financial risk. I’ve seen portfolios rise and fall fast, so your results will heavily depend on who you copy and when. Dub doesn’t give much risk analysis, so it’s up to you to do your homework.

4. Who owns the Dub app?

Dub, the copy-trading platform, is owned and operated by DASTA Incorporated.

5. How many users does the Dub app have?

As of the latest data available, the Dub app has a growing number of more than 1 million active users.

6. Who is the founder of Dub Invest?

Dub Invest was founded by Steven Wang, with the vision of democratizing investing by making it easier for everyday people to follow experienced investors. The platform was designed to allow users to benefit from professional strategies without needing years of experience.

7. What is the best trading app to make money?

There’s no universal “best,” but Dub stands out if you're into social trading. Apps like Robinhood or Webull are great for self-directed traders. I like that Dub lowers the barrier to entry and lets you learn by copying experienced investors, but you still need to be careful who you follow.

8. Is the Dub app legit?

Yes, the Dub app is a legitimate trading platform owned by DASTA Incorporated. It has over 1 million active users and has been featured in several fintech communities. That said, “legit” doesn’t mean risk-free—copy trading always comes with investment risk.

9. Is the Dub app safe?

Dub is safe in terms of account security, sign-in protection, and trade execution. However, safe doesn’t mean guaranteed returns. Since your investments mirror other traders, you’re exposed to the same ups and downs they experience.

10. How to use the Dub app?

Start by signing up, exploring portfolios, and selecting one that matches your goals. With as little as $100, you can copy trades automatically—if your chosen investor buys Apple or sells Tesla, your account does the same in proportion to your investment.

11. Is the Dub app legit for beginners?

Dub can be beginner-friendly because it lets you copy seasoned investors instead of making every decision yourself. But it doesn’t replace learning—if you’re new to trading, use Dub as a starting point while also studying basic investing principles to avoid blind risks.

12. Is the Dub app free?

Yes, Dub is free to download and explore. You only need to pay if you want Dub Premium, which unlocks advanced features like multiple portfolios. Premium costs $9.99 per month or $89.99 per year.

13. How does the Dub app compare to Autopilot?

Dub focuses on copy trading portfolios from real people, while Autopilot is more about automated investing with pre-set strategies. If you want human-driven portfolios, Dub is better; if you prefer algorithmic investing, Autopilot may be a fit.

14. Can you make money with the Dub app?

Yes, but it depends entirely on who you copy and market performance. Some users report strong gains, while others lose money. Copy trading is not guaranteed income—it carries the same risks as investing directly.

15. Does Dub app require a minimum investment?

Yes, you need at least $100 to start copying a portfolio on Dub. This amount is proportionally spread across the trades of the investor you choose.

16. Is Dub app good for long-term investing?

Dub can work for long-term strategies if you copy portfolios built for steady growth. However, since many users trade more actively, results may vary. Long-term investors should carefully choose stable portfolios rather than short-term plays.

17. Does Dub app charge hidden fees?

Dub itself charges only the Premium subscription for extra features. However, your brokerage may still apply its usual trading fees in the background. Always check your connected broker’s fee structure.

Bottom Line

So, is Dub worth trying? Honestly, yes, but with some caution.

It’s great for beginners who want exposure to the stock market without doing all the heavy lifting. The app’s intuitive design and social investing angle make it feel fresh. But it's not a guaranteed moneymaker, and the lack of transparency on fees and real-time performance may frustrate more serious users. If you're curious, try the free Premium trial. But treat it like learning to drive—you don’t just hand over the wheel and hope for the best.

Verdict: A promising tool for social investing—but not a set-it-and-forget-it money machine.

If you're looking to enhance your mental wellness while managing your investments, consider exploring tools like the Liven app. Check out our Liven app review for insights on how it can help boost your focus and productivity.

Spread the word

.svg)

.webp)

.webp)